IndiGo reported best ever fourth quarter net profit of ₹9,192 million; revenue up 76.5% to ₹141,606 million

Posted 18 May 2023

IndiGo continued on the path of profitability as it reported its best ever fourth quarter net profit of INR 9,192 million for the quarter ended March 2023. Excluding foreign exchange gain of INR 2,528 million, the net profit for the quarter aggregated to INR 6,664 million.

For the year ended March 2023, IndiGo reported a profit of INR 26,540 million, excluding foreign exchange impact. Including foreign exchange impact, IndiGo reported a net loss of INR 3,058 million for the year.

The profits of the third and the fourth quarters largely compensated for the losses incurred in the first and the second quarters.

Gurgaon, May 18, 2023: InterGlobe Aviation Ltd. (“IndiGo”) today reported its fourth quarter and fiscal year 2023 results

For the quarter ended March 31, 2023, compared to the same period last year

- Capacity increased by 2% to 30.4 billion

- Passenger numbers increased by 5% to 23.4 million

- Yield improved by 2% to INR 4.85 and load factor improved by 7.5 pts to 84.2%

- Revenue from Operations increased by 5% to INR 141,606 million

- Average fuel prices increased by 23.5% leading to increase in fuel CASK by 16.8% to INR 85

- CASK ex fuel decreased by 1% to INR 2.53 due to higher capacity.

- EBITDAR of INR 29,665 million (20.9% EBITDAR margin), compared to EBITDAR ofINR 1,718 million (2.1% EBITDAR margin)

- Profit excluding foreign exchange of INR 6,664 million compared to loss excluding foreignexchange of INR 10,695 million

- Net profit ofINR 9,192 million, compared to net loss of INR 16,818 million

For the year ended March 31, 2023, compared to year ended March 31, 2022

- Capacity increased by 5% to 114.4 billion

- Passenger numbers increased by 9% to 85.6 million

- Yield improved by 9% to INR 5.13 and load factor improved by 8.5 pts to 82.1%

- Revenue from Operations increased by 110.0% to INR 544,465 million

- Average fuel prices increased by 60.6% leading to increase in fuel CASK by 50.1% to INR 07

- CASK ex fuel decreased by 3% to INR 2.76 due to higher capacity

- EBITDAR of INR 73,116 million (13.4% EBITDAR margin), compared to EBITDAR ofINR 11,480 million (4.4% EBITDAR margin)

- Profit excluding foreign exchange of INR 26,540 million compared to loss of INR 52,210 million

- Net loss ofINR 3,058 million, compared to net loss of INR 61,618 million

- Basic earnings per share of negative INR 93

Profitability Metrics

| Particulars (INR mn) | Quarter ended | Quarter ended | ||||

|---|---|---|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | Mar‘23 | Dec‘22 | Change | |

| EBITDAR | 29,665 | 1,718 | +1,627.1% | 29,665 | 33,990 | -12.7% |

| PBT | 9,198 | (16,775) | +154.8% | 9,198 | 14,233 | -35.4% |

| PAT | 9,192 | (16,818) | +154.7% | 9,192 | 14,226 | -35.4% |

| Profit excluding foreign exchange | 6,664 | (10,695) | +162.3% | 6,664 | 20,091 | -66.8% |

| Particulars (INR mn) | Full year | ||

|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | |

| EBITDAR | 73,116 | 11,480 | +536.9% |

| PBT | (3,044) | (61,537) | +95.1% |

| PAT | (3,058) | (61,618) | +95.0% |

| Profit excluding foreign exchange | 26,540 | (52,210) | +150.8% |

Operational Metrics*

| Particulars | Quarter ended | Quarter ended | ||||

|---|---|---|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | Mar’23 | Dec‘22 | Change | |

| ASK (billion) | 30.4 | 20.4 | +49.2% | 30.4 | 28.8 | +5.8% |

| RPK (billion) | 25.6 | 15.6 | +63.8% | 25.6 | 24.5 | +4.7% |

| Load Factor | 84.2% | 76.7% | +7.5 pts | 84.2% | 85.1% | -0.9 pts |

| Passengers (million) | 23.4 | 14.6 | +60.5% | 23.4 | 22.3 | +4.8% |

*Includes non-scheduled operations

| Particulars | Full year | ||

|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | |

| ASK (billion) | 114.4 | 70.4 | +62.5% |

| RPK (billion) | 93.9 | 51.8 | +81.3% |

| Load Factor | 82.1% | 73.6% | +8.5 pts |

| Passengers (million) | 85.6 | 49.8 | +71.9% |

*Includes non-scheduled operations

Mr. Pieter Elbers, CEO, said, “With a combination of robust market demand and focused execution of our strategy, this was the second consecutive quarter wherein we produced strong operational and financial results, as we reported the highest ever fourth quarter net profit of 9,192 million rupees.

The companywide initiatives undertaken based on the three strategic pillars of Reassure, Create and Develop enabled us to end the year on a strong note with record revenues. I would like to thank the 86 million customers for choosing to fly with us in the financial year ended March 2023 and the 6E employees for their immense hard-work and dedication.”

Revenue and Cost Comparisons

Total income for the quarter ended March 2023 was INR 146,001 million, an increase of 77.9% over the same period last year. For the quarter, our passenger ticket revenues were INR 124,346 million, an increase of 80.6% and ancillary revenues were INR 14,459 million, an increase of 36.6% compared to the same period last year.

| Particulars (INR mn) | Quarter ended | Quarter ended | ||||

|---|---|---|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | Mar’23 | Dec‘22 | Change | |

| Revenue from operations | 141,606 | 80,207 | +76.5% | 141,606 | 149,330 | -5.2% |

| Other income | 4,395 | 1,867 | +135.4% | 4,395 | 4,772 | -7.9% |

| Total income | 146,001 | 82,075 | +77.9% | 146,001 | 154,102 | -5.3% |

| RASK* (INR) | 4.68 | 3.97 | +17.9% | 4.68 | 5.26 | -11.1% |

| Yield (INR/Km) | 4.85 | 4.40 | +10.2% | 4.85 | 5.38 | -9.8% |

*Net of finance income of INR 3,669 million, INR 1,201 million and INR 2,660 million for quarter ended Mar’23, Mar’22 and Dec’22 respectively

| Particulars (INR mn) | Full year | ||

|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | |

| Revenue from operations | 544,465 | 259,309 | +110.0% |

| Other income | 14,350 | 7,256 | +97.8% |

| Total income | 558,814 | 266,565 | +109.6% |

| RASK* (INR) | 4.80 | 3.73 | +29.0% |

| Yield (INR/Km) | 5.13 | 4.24 | +20.9% |

*Net of finance income of INR 9,445 million and INR 4,367 million for full year ended Mar’23 and Mar’22 respectively

Total expenses for the quarter ended March 2023 were INR 136,803 million, an increase of 38.4% over the same quarter last year.

| Particulars (INR mn) | Quarter ended | Quarter ended | ||||

|---|---|---|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | Mar’23 | Dec‘22 | Change | |

| Fuel cost | 56,130 | 32,206 | +74.3% | 56,130 | 57,851 | -3.0% |

| Other costs excluding fuel | 80,673 | 66,644 | +21.1% | 80,673 | 82,018 | -1.6% |

| Total cost | 136,803 | 98,850 | +38.4% | 136,803 | 139,869 | -2.2% |

| CASK* (INR) | 4.38 | 4.79 | -8.6% | 4.38 | 4.77 | -8.2% |

| CASK ex fuel* (INR) | 2.53 | 3.21 | -21.1% | 2.53 | 2.76 | -8.2% |

| CASK ex fuel ex forex* (INR) | 2.61 | 2.91 | -10.1% | 2.61 | 2.55 | +2.3% |

*Net of finance income of INR 9,445 million and INR 4,367 million for full year ended Mar’23 and Mar’22 respectively

Total expenses for the quarter ended March 2023 were INR 136,803 million, an increase of 38.4% over the same quarter last year.

- Netof finance income of INR 3,669 million, INR 1,201 million and INR 2,660 million for quarter ended Mar’23, Mar’22 and Dec’22 respectively

| Particulars (INR mn) | Full year | ||

|---|---|---|---|

| Mar‘23 | Mar‘22 | Change | |

| Fuel cost | 236,460 | 96,952 | +143.9% |

| Other costs excluding fuel | 325,398 | 231,150 | +40.8% |

| Total cost | 561,858 | 328,102 | +71.2% |

| CASK* (INR) | 4.83 | 4.60 | +5.0% |

| CASK ex fuel* (INR) | 2.76 | 3.22 | -14.3% |

| CASK ex fuel ex forex* (INR) | 2.50 | 3.09 | -18.9% |

*Net of finance income of INR 9,445 million and INR 4,367 million for full year ended Mar’23 and Mar’22 respectively

Cash and Debt

As of 31st March 2023

- IndiGo had a total cash balance of INR 234,243 million comprising INR 121,948 million of free cash and INR 112,295 million of restricted cash.

- The capitalized operating lease liability was INR 415,477 million. The total debt (including the capitalized operating lease liability) was

INR 448,542 million.

Network and Fleet

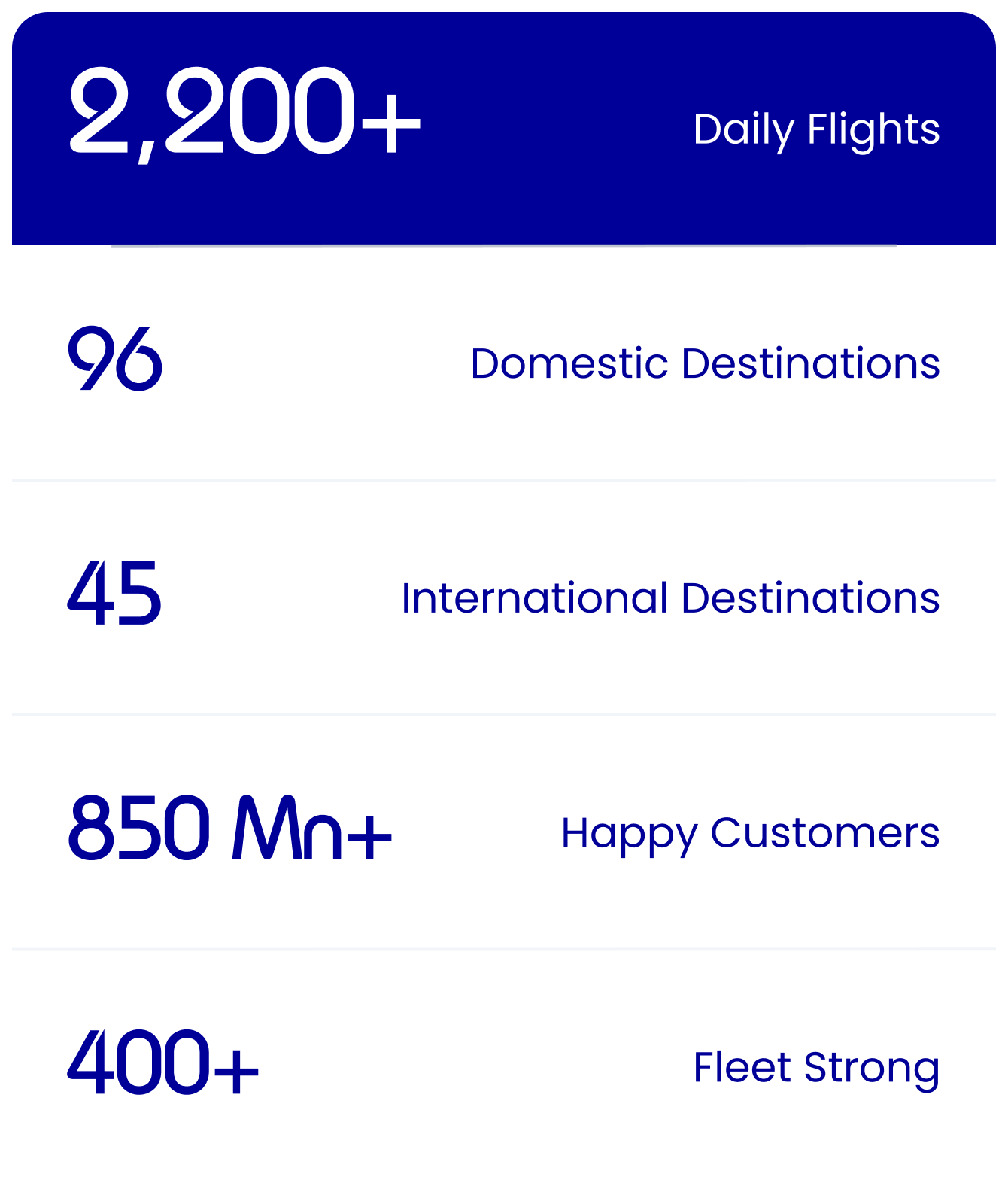

- As of 31st March 2023, fleet of 304 aircraft including 21 A320 CEOs, 162 A320 NEOs, 79 A321 NEOs, 39 ATRs, 2 A321 freighters and 1 B777 (damp lease); a net increase of 2 passenger aircraft during the quarter.

- IndiGo operated at a peak of 1,815 daily flights during the quarter including non-scheduled flights.

- During the quarter, provided scheduled services to 78 domestic destinations and 22 international destinations.

- During the quarter, provided services to 30 additional international destinations through strategic partnerships.

Operational Performance

For the period January-March’23

- IndiGo had a Technical Dispatch Reliability of 99.92%.

- IndiGo had an on-time performance of 88.5% at four key metros and flight cancellation rate of 0.86%.

Future Capacity Growth

- First quarter of fiscal year 2024 capacity in terms of ASKs is expected to increase by around 5-7% as compared to the fourth quarter of fiscal year 2023.

Awards and Accolades

- IndiGo was awarded “Top Airline by Absolute Passenger Growth (South Asia)” at Changi Airline Awards 2023.

- IndiGo was awarded 'Fast Runners in Disability’ award at the ‘Disability Positive Summit & Awards’ 2023, for its contribution in the DEI (Diversity, Equity and Inclusion) space.

- IndiGo was awarded the gold award at ‘Afaqs! Digies – Digital Awards 2023’ for the ‘best use of YouTube’.

Conference Call

The Company will conduct a live audio earnings call today, May 18 at 5 pm IST which will be available to the public on a listen only mode followed by Q&A session. The dial-in details are given below:

| Dial-in Numbers | ||

|---|---|---|

| Universal Access | Primary Number: +91 22 6280 1311 or +91 22 7115 8212 | |

| Local Access | Primary Number: 1 800 120 1221 | |

| Other Regions | USA: | 18667462133 |

| UK: | 08081011573 | |

| Singapore: | 8001012045 | |

| Hong Kong: | 800964448 | |

| Japan: | 00531161110 | |

| Pre-register at the following URL and get your unique dial-in details for the call | ||

| Diamond Pass | https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=6873680&linkSecurityString=22f58ed240 | |

About IndiGo

IndiGo is amongst the fastest growing low-cost carriers in the world. IndiGo has a simple philosophy: offer fares that are low, flights that are on time, and a courteous, hassle-free travel experience. It had a fleet of 304 aircraft and provided scheduled services to 78 domestic and 22 international destinations as of 31st March 2023.

Disclaimer

This document may contain some statements on the Company’s business or financials which may be construed as forward-looking. The actual results may be materially different from these forward-looking statements.