Strong start to the year as IndiGo reported its highest ever quarterly revenue

Gurgaon, August 02, 2023: InterGlobe Aviation Ltd. (“IndiGo”) today reported its first quarter fiscal year 2024 results.

Strong start to the year as IndiGo reported its highest ever quarterly revenue of INR 171,609 million and highest ever quarterly net profit of INR 30,906 million. This reflects strong operational performance, execution of our strategy and favorable market conditions.

For the quarter ended June 30, 2023, compared to the same period last year

- Capacity increased by 18.8% to 32.7 billion.

- Passenger numbers increased by 30.1% to 26.2 million.

- Yield declined by 1.2% to INR 5.18 and load factor improved by 9.0 pts to 88.6%.

- Revenue from Operations increased by 29.8% to INR 166,831 million.

- Average fuel prices decreased by 22.5% leading to decrease in fuel CASK by 26.6% to INR 1.60

- CASK ex fuel decreased by 11.4% to INR 2.57 due to higher capacity.

- EBITDAR of INR 52,109 million (31.2% EBITDAR margin), compared to EBITDAR of INR 7,169 million (5.6% EBITDAR margin).

- Profit excluding foreign exchange of INR 29,745 million compared to profit excluding foreign exchange of INR 3,603 million.

- Net profit of INR 30,906 million, compared to net loss of INR 10,643 million.

Profitability Metrics

| Particulars (INRmn) | Quarterended | ||

|---|---|---|---|

| Jun‘23 | Jun‘22 | Change | |

| EBITDAR | 52,109 | 7,169 | +626.8% |

| PBT | 30,907 | (10,642) | +390.4% |

| PAT | 30,906 | (10,643) | +390.4% |

| Profit excluding foreign exchange | 29,745 | 3,603 | +725.5% |

Operational Metrics*

| Particulars | Quarterended | ||

|---|---|---|---|

| Jun‘23 | Jun‘22 | Change | |

| ASK (billion) | 32.7 | 27.5 | +18.8% |

| RPK (billion) | 29.0 | 21.9 | +32.3% |

| Load Factor (%) | 88.6% | 79.6% | +9.0 pts |

| Passengers (million) | 26.2 | 20.1 | +30.1% |

*Includes non-scheduled operations

Mr. Pieter Elbers, CEO, said,

“I am pleased to report a solid start to the year building on the positive momentum from the last twoquarters. We produced strong operational performance and welcomed the highest number of quarterlypassengers which enabled us to generate the highest ever quarterly revenue and net profit for the quarterended June 2023. During this quarter, we placed a new order for 500 aircraft that takes our outstandingorderbookto c.1,000 aircraftandfurtherstrengthensour positionforfuture growth.

My deepest gratitude to all our loyal customers and dedicated 6E stars for the progress we have madetowardsour(new)growth strategy -towardsnewheights and acrossnew frontiers.”

Revenue and Cost Comparisons

Total income for the quarter ended June 2023 was INR 171,609 million, an increase of 31.8% over the same period last year. For the quarter, our passenger ticket revenues were INR 149,956 million, an increase of 30.8% and ancillary revenues were INR 15,484 million, an increase of 20.4% compared to the same period last year.

| Particulars (INRmn) | Quarterended | ||

|---|---|---|---|

| Jun‘23 | Jun‘22 | Change | |

| Revenue from operations | 166,831 | 128,553 | +29.8% |

| Other income | 4,778 | 1,635 | +192.2% |

| Total income | 171,609 | 130,188 | +31.8% |

| RASK* (INR) | 5.12 | 4.69 | +9.0% |

| Yield (INR/Km) | 5.18 | 5.24 | -1.2% |

*Net of finance income of INR 4,360 million and INR 1,105 million for quarter ended Jun’23 and Jun’22 respectively

Total expenses for the quarter ended June 2023 were INR 140,701 million, a decrease of 0.1% over the same quarter last year.

| Particulars (INRmn) | Quarterended | ||

|---|---|---|---|

| Jun‘23 | Jun‘22 | Change | |

| Fuel cost | 52,281 | 59,901 | -12.7% |

| Other costs excluding fuel | 88,420 | 80,930 | +9.3% |

| Total cost | 140,701 | 140,831 | -0.1% |

| CASK* (INR) | 4.17 | 5.08 | -17.9% |

| CASK ex fuel* (INR) | 2.57 | 2.90 | -11.4% |

| CASK ex fuel ex forex* (INR) | 2.61 | 2.38 | +9.3% |

- Netof finance income of INR 4,360 million and INR 1,105 million for quarter ended Jun’23 and Jun’22 respectively

Cash and Debt

As of 30th June 2023

- IndiGo had a total cash balance of INR 274,000 million comprising INR 156,911 million of free cash and INR 117,090 million of restricted cash.

- The capitalized operating lease liability was INR 430,862 million. The total debt (including the capitalized operating lease liability) was INR 462,919 million

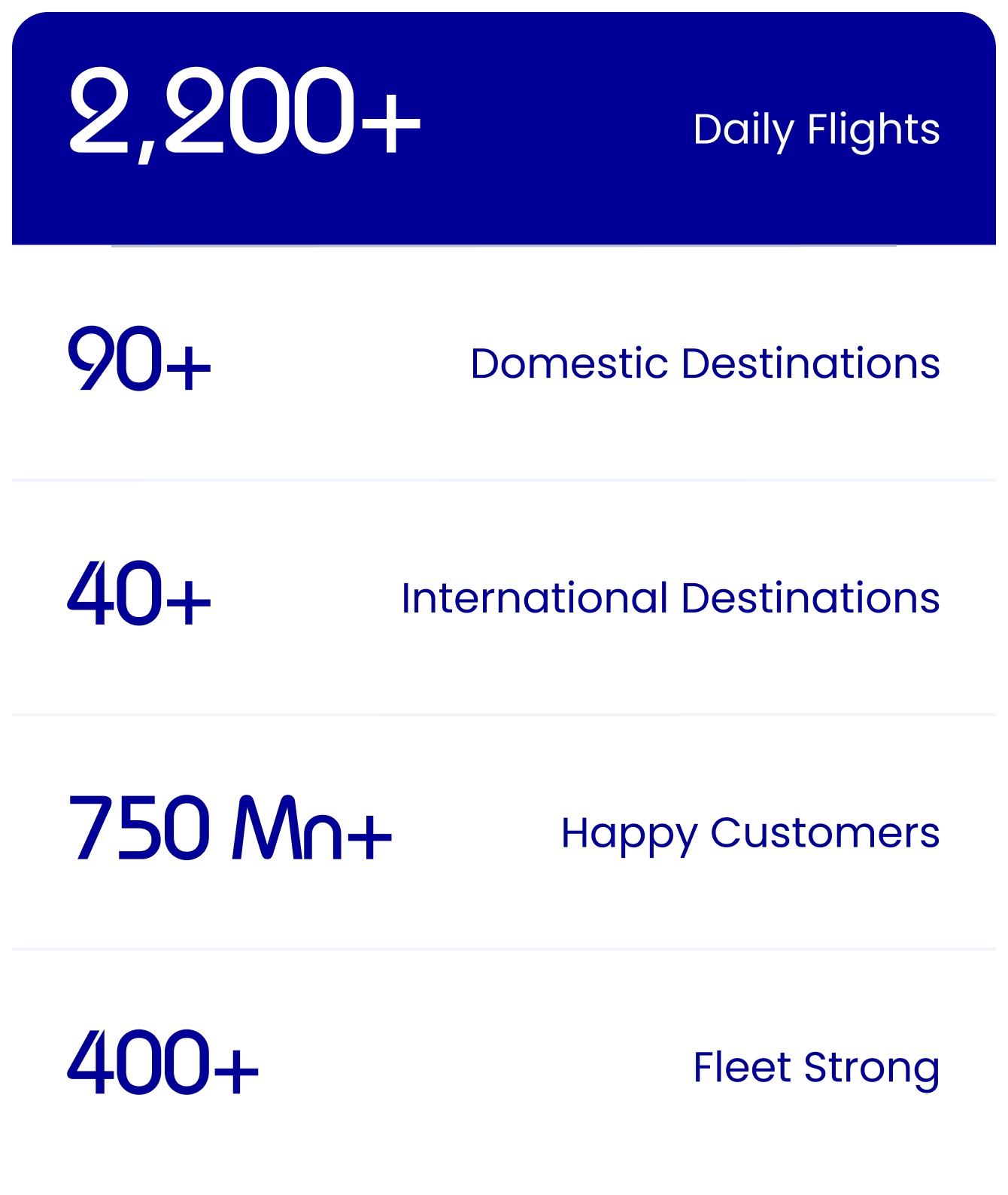

Network and Fleet

- As of 30th June 2023, fleet of 316 aircraft including 20 A320 CEOs, 166 A320 NEOs, 87 A321 NEOs, 39 ATRs, 2 A321 freighters and 2 B777 (damp lease); a net increase of 12 passenger aircraft during the quarter.

- IndiGo operated at a peak of 1,873 daily flights during the quarter including non-scheduled flights.

- During the quarter, provided scheduled services to 78 domestic destinations and 22 international destinations.

- During the quarter, provided services to 37 additional international destinations through strategic partnerships.

Operational Performance

For the period April-June’23

- IndiGo had a Technical Dispatch Reliability of 99.92%.

- IndiGo had an on-time performance of 89.2% at four key metros and flight cancellation rate of 0.30%.

Future Capacity Growth

- Second quarter of fiscal year 2024 capacity in terms of ASKs is expected to increase byaround 25% as compared to the second quarter of fiscal year 2023.

Awards and Accolades

- IndiGo was awarded “The Best Low-Cost Airline in India and South Asia” at the Skytrax World Airline Awards 2023.

- IndiGo ranked as the world’s “Top 50 most valuable Airline Brands” by Brand Finance – Only Indian Airline to make it to the list for 3 consecutive years.

About IndiGo

IndiGo is amongst the fastest growing low-cost carriers in the world. IndiGo has a simple philosophy: offer fares that are low, flights that are on time, and a courteous, hassle-free travel experience. It had a fleet of 316 aircraft and provided scheduled services to 78 domestic and 22 international destinations as of 30th June 2023.